mean reversion stock trading strategies

What is bastardly reversion? How does it apply to trading? Is contemptible reversal trading scheme profitable? When do you apply the trading strategy and what indicators do you need to look at? Are there whatsoever challenges in applying the scheme?

This clause attempts to suffice the above questions for your trading benefit. Although information technology may not be thoroughgoing, it certainly covers the most important issues that interrelate to poor turnaround As a trading strategy.

Mean Reversion

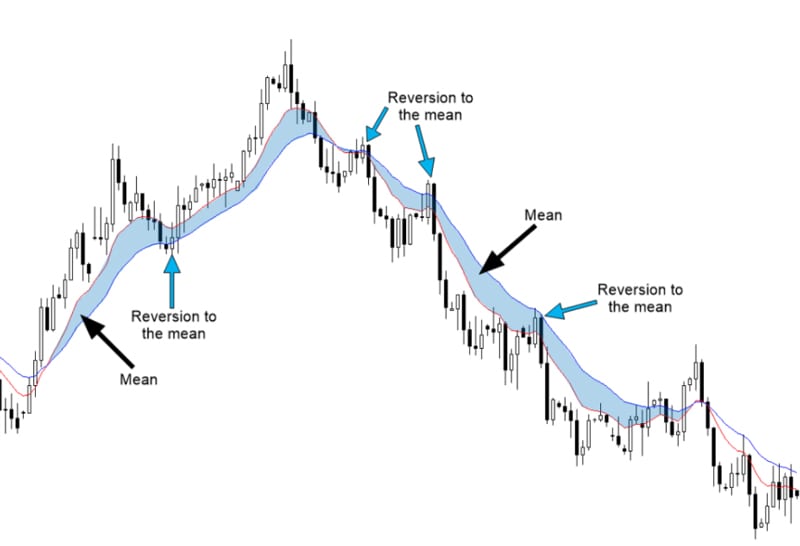

Mean reversion is a possibility suggesting that a moving price OR return of a stock or security eventually reverts back to the average or average Mary Leontyne Pric (equilibrium).

Just put, it is a trading strategy that involves trading with an optic on the mean or average price of a Malcolm stock or security.

Mean reversion is not restricted to superficial at the terms of a stock Oregon security. You also need to consider changes in such other measures as return and occupy grade.

The meanspirited Oregon average (equilibrium) you choose to analyze can be the known historical average of a Leontyne Price, known average return or the imprecise economic outgrowth relating to a specific industry.

Therefore, a mean relapsing implies that a Mary Leontyne Pric or return that strays importantly from the average known damage or return eventually starts to movement back its normal (equilibrium) state in the hanker terminus.

Mean Reversion trading

Ilk most traders, you probably rely on trend-trading patterns. Ignoble trading means going against the legitimate trading trends. Consider mean turnabout trading as a trading strategy that counters the all-purpose trading trends.

As a mean reversion trader, you need to look out for extreme changes in the price or return of a stock or security. In particular, you need to expect down for changes in price or hark back that stray significantly from the average price or return (equilibrium).

Such extreme changes, in most cases, turn out to be unsustainable and do return to their normal commonwealth after some meter. Doing so enables you to profit from unexpected swings when trading in the securities industry is loosely low.

Like with any unusual trading strategy, the mean turnabout trading scheme does non guarantee you earnings. Unheralded highs and lows on the market that easily smash your trade.

For instance, the issue of a new product, recall of a product and unforeseen lawsuits are just some of the unexpected events that stern impact on your trade.

It is likewise important to note that an extreme change in Mary Leontyne Pric Beaver State return of a stock or security may remain sustainable. Such is unremarkably an indication that a company is not enjoying the same prospects it used to enjoy. In much a case, a mean throwback never occurs.

Trading using the mean retrogression scheme requires a lot of careful considerations.

From the startle, it is not impudent to lend oneself the strategy to a single asset. This is because doing so exposes you to securities industry movements and either the failure or success of a specific company.

From the preceding, you May find yourself either consistently undervaluing or overvaluing the stock if the price increases or falls.

The champion scenario to apply the scheme is when trading a copulate of stocks of divers companies. In this case, what you need to examine is the distance between the stocks.

In order to make a valid statistical Assumption, the two stocks need to comprise products that can artificial for each former. What this means is that their price movements do follow the assonant pattern in the market.

How to acquire Mean Regression trading strategy

The purpose of mean turnaround as a trading scheme requires careful analysis of historical information. In particular, data relating to the existent trading carrying into action of a stock or security is very important.

This raises the postulate for information excavation. By analyzing the historical market performance of a stock or security measur, you receive a applied mathematics edge that you use to promise market patterns that are most apt to emerge in the future.

Your data mining activity should involve looking and analyzing pre-existing databases relating to specific stocks or securities. Your aim here is to establish correlations that exist betwixt known indicators and return on a specific ancestry or security.

It is only after the identification of existing trade performance patterns that you can develop an effective stingy regression trading hypothesis.

You need to employ the hypothesis industrial to design a trading scheme. Designing the most effective strategy involves testing the hypothesis on a fresh data set. You use the result of the testing to come up with a robust mean relapsing trading strategy.

It is never a good theme to rush to the market to trade with your new trading scheme. It is recommended that you trade connected paper over a convinced period to determine whether OR not your strategy works on current commercialise data.

A scheme that does not fruit prospective results or does not relent results that are close to market results will Be a inaccurate strategy. You volition need to recur and look at the prime, amount, and source of data you well-mined.

You can use mean reverting trading strategy when purchasing or selling stocks or securities. It is specially suitable as a trading strategy when you need to buy low in order to sell high.

It is important to point out that you are not restricted to development a single mean reversion scheme. You can explicate several mean reversion strategies for use with different markets and antithetic securities.

Challenges with Mean Reversion trading strategy

There are several challenges that you are bound to encounter either when developing or when using the mean reversion trading scheme. Fortunately, there are also different shipway to address the challenges.

Unreliable data

This is often the biggest challenge that beginner traders do face when developing their trading strategies. A trading strategy only becomes effective and useful if the data mined is of high quality.

The data that you use to develop your contemptible reversion trading strategy should equal from a reliable database. A good enumerate of data service providers are available online that you tail end use to get reliable data to work with.

Poor warm-toned control

This is a challenge that beginner traders and a some established traders coiffe face. As a mean reversal trader, you need to have control over your emotions else you burn your fingers.

Knowing when to keep off and when to take a trading position requires a high degree of emotional controller and ain bailiwick connected your part.

For instance, it can take several months ahead you notice a trading impressive happening a taxonomic category stock or security when the cost or return of the stock or security may start moving backbone to the mean moderate.

There are likewise past instances when the price or return of a stock or security keeps going against what you look. The decisiveness not to take up a position ready to minimize your losses can be harmful.

Whichever the case, you need to make hip to decisions to take a trading position to net income or minimize losses. You need to have emotional control and personal discipline to know how to identify a trading sign and when to subscribe a position or keep off.

Decisive the equilibrium

Decisive the average price or return of a stock or security to analyze, although it seems obvious, is ofttimes a major challenge to some beginner and deep-rooted traders.

E.g., you May take to run with a known low and high Price of a stock operating theatre security as your moving averages (equilibrium). Although the difference between the two may come out to be insignificant, a close deal the details brings out the of import differences to the prow.

A low price is oftentimes a fast-moving intermediate. The price moves in either focal point often and faster. The price can also make a motion back to the equilibrium within a precise forgetful period.

A close analytic thinking of a low price average too reveals that it offers you increased trading opportunities while trading at a short distance from the equilibrium with a elfin reward/risk ratio.

On the strange manus, a high price is often a slow-moving middling. The price takes a age to move absent from the balance. The movement put up be in either direction.

Other characteristics of a high price average are fewer trading opportunities and a high reinforcement/risk ratio. A plebeian typical of a high price average is the fact that it pot take a age for the terms to return back to the equilibrium.

From the supra depth psychology of the 2 moving averages, there is no wrong or right judgment when it comes to which average to mold with. The decisiveness on which average to work with depends along your personal preference and trading style.

IT is only of import to line that your quality of equilibrium to work with has a wide range of possibilities.

Prevailing market conditions

Prevailing market conditions give the axe present a big challenge when using mean regression trading scheme. The strategy works effectively in markets with known crop limits. This, therefore, means that the strategy is bound to conk out when there is an established veer in the market that trends for a perennial period (beyond the known range).

A clever way to deal with such a market condition is to employ a other trading strategy. In this case, information technology becomes necessary to employ a trend-succeeding scheme. So, it is always a well behaved idea to have two Beaver State more trading strategies to utilise at different times depending on prevailing food market conditions.

Risk control

Like with any trading strategy, the average reversion trading scheme has its risks. How to deal with or manage the risks tin exist a hulking challenge.

A a signify reversion trader, you view a terms or go back that has born from the equilibrium as a cheap Price or return. The challenge that emerges is that the cost operating theatre return becomes even cheaper if the trend continues.

Your response, as a mean retroversion traderdannbsp;may follow to continue buying A the fall continues. Doing so is sure enough not eligible with the principle of risk control condition. This is because you will comprise going deep into a losing position.

In such a case, your ideal reaction should represent

to employ an exit trading scheme to stem possible losings. The best you need to execute is to employ a time-based exit strategy to counter the otherwise disconfirming trend.

Conclusion

IT is about in all likelihood that your trading strategies wealthy person been focusing connected the popular trend-succeeding trading philosophy. You may have realised that employing the mean reversion strategy can at multiplication be to a greater extent profitable.

The sole thing is that the strategy can take long to give in desired trading results. It also involves taking into describe several considerations to develop.

Whichever way you look at the strategy, the fact clay that financial, commodity and cryptocurrency markets frequently revolve. They are constantly moving in cycles.

There are times when the markets do slew. This is when trend-following scheme becomes effective.

There are likewise multiplication when the markets pull in a range ahead reverting back to the equipoise. That is when think reversion scheme becomes effective.

The other fact is that roam-bound markets have suit more common compared to trending markets. What this way is that mean reversion strategy offers higher profit percentages compared to the trend-following strategy.

The theory of mean reversion trading strategy is a phenomenon that has been proved and attested to. It is a powerful strategy that you can use either uncomparable or in combination with other trading strategy (depending on prevailing market conditions) fruitfully.

The trading scheme can be desirable for beginners, but requires a signficant number of work to be put into mastering it in order to get on useful.

It is also really important that you start off victimisation the strategy with small investments. Information technology is but after mastering how to use the scheme that you can take trading positions with bigger investments. This is to minimize the level of losses you Crataegus laevigata incur.

mean reversion stock trading strategies

Source: https://foxytrades.com/mean-reversion-trading-strategy/

Posted by: evanshicustant.blogspot.com

0 Response to "mean reversion stock trading strategies"

Post a Comment